Blackbird Ventures has led a $50 million Series C investment round in nanosatellite system company Fleet Space Technologies.

Other investors in the round included the defence-focused 1941 Fund, which was raised by Joe Hockey-founded Bondi Partners’, superannuation funds Hostplus and TelstraSuper, plus Grok Ventures, Alumni Ventures and Pavilion Capital.

According to Adelaide-based Fleet the round was heavily oversubscribed.

The new round values Fleet at around $350 million, more than double the valuation generated by the company’s $US26.4 million Series B raise in 2021 which was also oversubscribed. Investors in that round included Blackbird, Grok, Hostplus, Alumni, Artesian Venture Partners, In-Q-Tel and Hong Kong-based Horizons Ventures.

Aerospace engineers Flavia Tata Nardini and Matthew Tetlow founded Fleet in 2015 to low-orbit small cube satellites and ground systems that could provide communications for industries such as agriculture, mining and transport.

Fleet’s first commercial satellites were launched in 2018.

In April, Fleet entered into its first defence contract with a $6.4 million deal with Australia’s Defence Space Command which will see its commercial satellites used to develop and demonstrate a low earth orbit (LEO) satellite communications system.

Tata Nardini, who is the company’s chief executive, said that since launching its ExoSphere product, the company had gained international customers and achieved the milestone of reaching $28 million in annual contracted revenues.

She said this revenue growth and strong customer acquisition had been a “driving force” behind the success of the Series C fundraising.

Tata Nardini noted that the US Energy Information Administration had pointed out that the world will need hundreds of new mines to meet the critical mineral demands of the transition to renewable energy.

“We are believers that space-enabled data in exploration will allow the search for critical minerals to speed up so much that we will be able to reach humanity’s targets for net zero,” she said. “With this capital we aim to map the sub surface of Earth and find the deposits that are needed with a much lower environmental impact.”

Blackbird co-founder Niki Scevak said: “Fleet Space Technologies has made stunning progress over the past year with a game-changing product loved by customers. The company’s strong traction and sales during this time build on the team’s technical leaps forward.”

He said Blackbird had been an investor in Fleet from its earliest days and the latest fundraising had deepened its conviction that the company would be successful into the future.

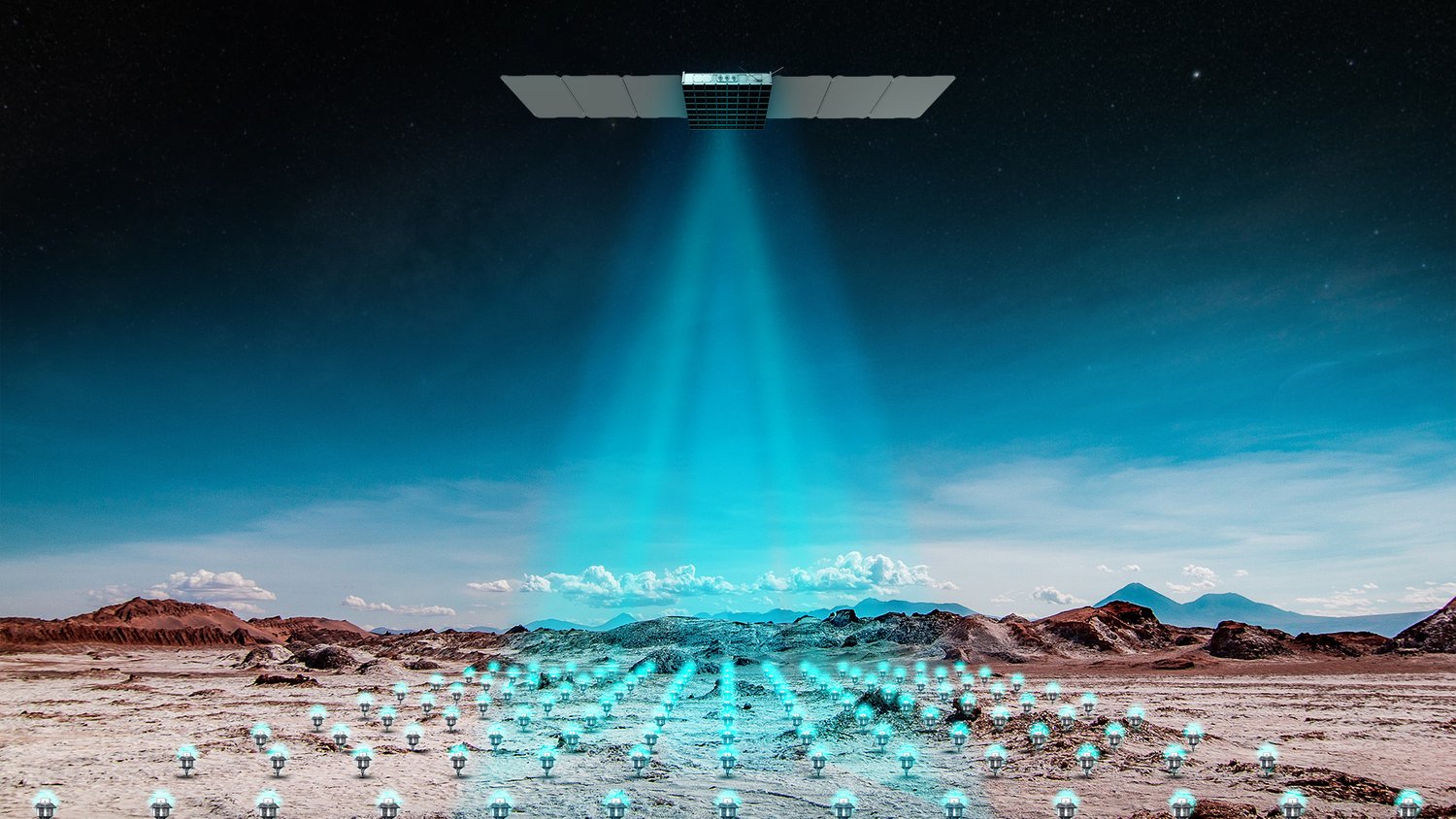

Fleet’s ExoSphere satellite-based minerals exploration technology is currently being used by more than 30 clients globally including Rio Tinto, Barrick Gold, Core Lithium and Gold Fields with well over 100 surveys for mineral exploration projects completed or in progress.

North Ridge Partners was Fleet’s financial adviser for the Series C capital raising.

Fleet interprets sub-surface data from ExoSphere surveys using AI and machine learning and the company says this is enabling it to develop new analytics products for exploration teams.

The company’s roadmap for these products includes predictive drill targeting models, lithology models and other multi-physics models giving exploration teams greater certainty faster. In parallel, the company is also working on redesigning its Geode ground sensors to make them smaller, lighter, and capable of acquiring multiple types of data simultaneously.

Image: How the ExoSphere system works.