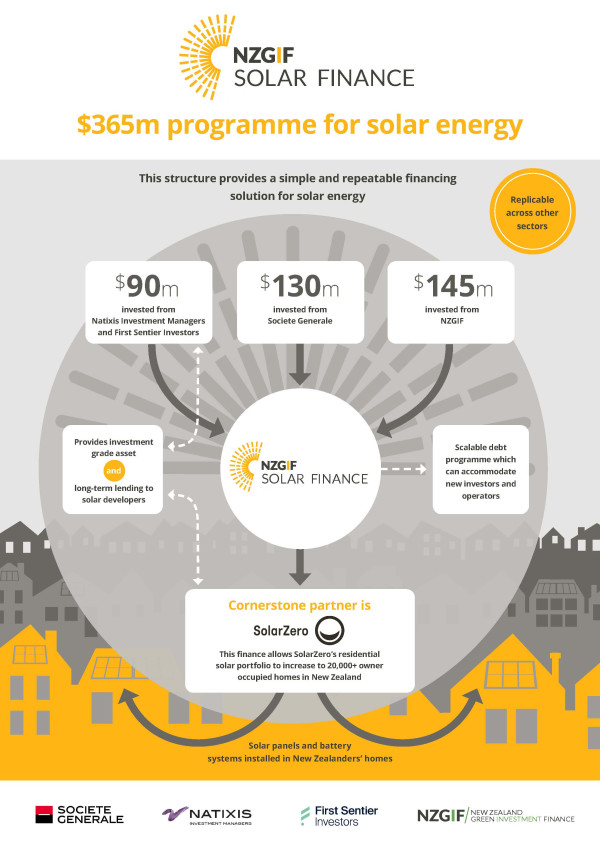

Debt investment firm New Zealand Green Investment Finance (NZGIF) has attracted additional debt funding of $NZ130 for its Solar Finance scheme which provides medium to long-term debt to providers of domestic solar energy generation.

The new debt facility has been provided by European bank Societe Generale. This follows provision of a combined debt facility of $NZ90 million in September last year by First Sentier Investors and Natixis Investment Managers. NZGIF has invested $NZ145 million into the scheme.

NZFIF finances Aotearoa New Zealand’s largest residential power purchase agreement (PPA) portfolio which is managed by SolarZero. The total lending facility of $NZ365 million is adequate to help provide affordable renewable generation to more than 20,000 households.

NZGIF chief investment officer Jason Patrick said: “NZGIF Solar Finance is structured for growth. Private capital provides the scale that’s needed to accelerate investment into decarbonisation.

“Societe Generale, First Sentier Investors and Natixis Investment Managers all see value in New Zealand’s renewable energy sector. Our opportunity is to now harness this type of financial support, from domestic and offshore investors, towards other sectors and additional partners, capable of reducing New Zealand’s carbon emissions.”

Co-head of securitisation and fund financing for Asia Pacific at Societe Generale, Arkady Lippa, said: “NZGIF Solar Finance is the first program of its kind in Australasia, and it represents an excellent investment opportunity for New Zealand. We are pleased to leverage our innovative financing solutions and support New Zealand’s energy transition as part of Societe Generale’s long-term commitment to decarbonisation.”

Solar generation currently provides only about 1% of New Zealand’s electricity. Domestic rooftop systems are seen as an important component in increasing this to around 13% by 2050.

Patrick said NZGIF’s Solar Finance product bridges the gap between market requirements and financing. He said solar system providers needed access to long-term fixed-rate debt as well as warehousing debt facilities, but existing debt providers had been cautious about financing the more disruptive and innovative participants in the sector.

“We took a bundle of residential solar assets and solar contracts and were able to structure them for investors in this program,” Patrick said. “Under attractive criteria and standardised terms, we created an opportunity that has brought in offshore investors looking for long-term investment.”

Image: How NZGIF’s financing system works.