Auckland-based Icehouse Ventures has issued an unusual public progress report on its growth investing to date as it nears first close for its second fund in the segment.

Icehouse Ventures Growth Fund I raised $NZ110.3 million in 2020. Growth Fund II has so far attracted commitments of $NZ98 million, including a recent commitment by a new institutional investor.

Chief executive Robbie Paul says he is confident that, like its predecessor, Icehouse Growth Fund II will be oversubscribed beyond the target of $NZ100 million by the 31 December final close.

With the New Zealand economy currently in recession, raising close to the amount raised by the first growth fund should be seen as successful.

Icehouse Ventures has provided extensive information during its fundraising. In an unusual move for a venture firm, the firm publicly released this year’s annual investor report for Growth Fund I. While naturally focusing on progress achieved by investee companies, the report provides context on the specific challenges of a growth fund: scaling up promising innovation and converting venture capital-supported operations into self-funding profitable businesses. This is still a work in progress for most of the Fund I investees, however, as we have reported previously, one investment has been profitably exited: Tradify with its acquisition by UK-based business The Access Group.

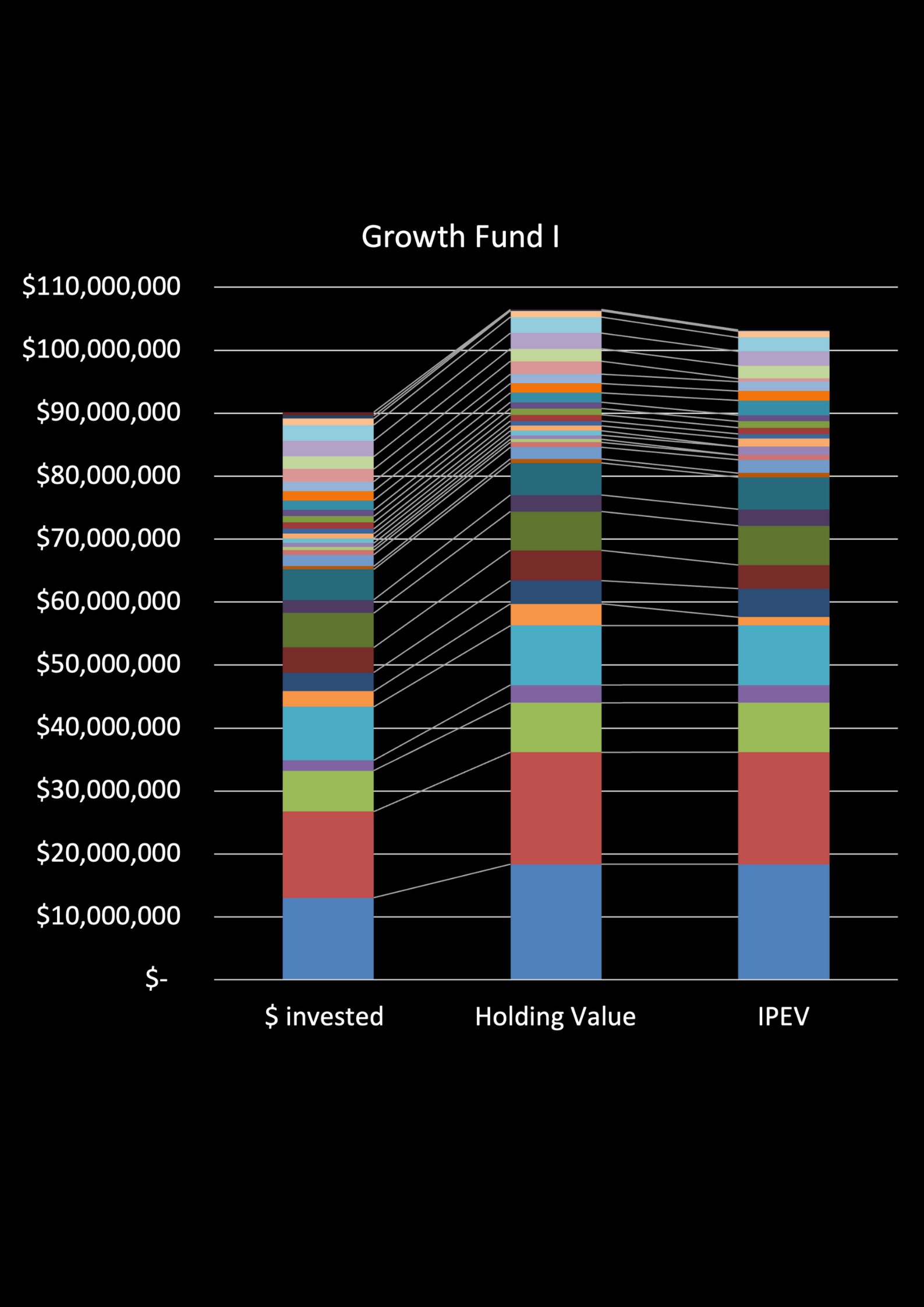

Of the $NZ110.3 million raised for Growth Fund I, just under $NZ90.2 million has now been deployed. The fund invested in 32 New Zealand tech companies over 51 funding rounds.

Growth Fund II is to be invested in 20 companies, so larger sums in a smaller number of companies. Some of these investments will be in Growth Fund I investees, or Icehouse’s wider portfolio, while others will be in New Zealand companies in which Icehouse has not previously invested.

Investments from Fund II have already been made in Fund I investees Halter and Crimson Education while Vessev is also expected to receive further funding.

Investments have similarly been made in companies outside the Icehouse wider portfolio including Re-Leased and Timescapes.

Paul says a key question when raising Fund I in 2020 was whether there were enough companies in New Zealand that merited growth capital. With experience in early-stage venture investing, the Icehouse team was convinced there were, but there were fewer proof-points then than today.

Over the years, Icehouse has been on the receiving end of plenty of scepticism over the investments it has made, Paul says. This was certainly the case for more than five years after the firm first invested in electric foiling watercraft developer Vessev. That scepticism abated only after the company launched a passenger ferry which incorporates the two technologies. And, at times, scepticism still persists over university admissions support company Crimson Education, despite the company’s team of now more than 900 delivering incredible outcomes for students globally and generating $NZ100s of millions in revenue.

Since 2020, Paul says: “The commercial and technical wins of Halter, Dawn Aerospace, Hnry, Crimson, Tradify, Tracksuit, Sharesies, and Shuttlerock have truly put NZ on the map.” And, outside the Icehouse Ventures portfolio, there have been many more Kiwi success stories such as Kami, Auror, Robotics Plus and Oritain.

So, what lessons have been learned? According to Paul, key takeaways from the Growth Fund I annual report include:

Sometimes you must take a step backwards to move ahead …

Nineteen of the 32 investee companies have had to reduce the size of their teams. Nine of those reduced their teams by more than a third.

While the processes resulted in significant stress and disruption for all involved and introduced uncertainty that all the founders regretted, most also acknowledged that the end-result was a more efficient and happier team with a greater concentration of high performers.

A part of thriving is simply existing …

Shuttlerock, Parrot Analytics and Tradify are great examples of this. Each has achieved brand awareness, industry recognition, customer relationships and retention and team experience that is enabling significant growth. These strengths generally only come with time. Tradify is a great example. While the company had achieved excellent traction in New Zealand and Australia, its launch in the UK required significant effort and time to build awareness and trust. Now that the company has established itself in the UK market, it is generating above 50% year-on-year growth.

Runway can be stretched further than you think ...

For the five years leading up to 2023, the portfolio companies averaged a capital raise every 18 months. Typically, these raises coincided with both growing ambitions and shrinking cash balances. To give time to achieve key milestones, most companies hold off raising capital to the latest possible moment. Following the peak of 2021, many companies had to adjust their milestones and runway to reflect the malaise of the capital markets. Six portfolio companies have now stretched their runways by an additional 12 months, or more, through robust cash management and increased revenue.

Raise more than you think you need …

Even established companies struggle to precisely model capital requirements and all the opportunities and problems that emerge. Several companies were materially hamstrung by supply chain delays in the wake of COVID. That Open Star and Mint were able to assemble parts from around the world to launch their facilities was incredible. In two other cases, companies experienced near fatal technology recalls. In both cases, the companies were fortunate that their recalls took place after significant capital raises. Had they happened months earlier, the prospects of a successful capital raise – and indeed survival – would have been low. In one instance, the recall coincided with a major customer reneging on a contract that represented more than 50% of the company’s revenue. It is unlikely this company would still be operating today had they not oversubscribed their round by more than $NZ5 million.

It's not all bad news out there …

Despite the general cynicism in the market, Growth Capital I portfolio companies have added more than $NZ250 million in annual revenue over the last few years. This growth comes from companies expanding geographies (LawVu entering the US. Hnry entering Australia), industries (halter in agtech and Crimson in edtech), and business models SaaS (Tradify) and medtech (the Insides Co).

Paul says investing should be about making a series of decisions. Growth Fund I started with relatively small investments in companies such as Hnry, Halter, Dawn Aerospace and Crimson. Significantly larger investments were then made over successive rounds, milestones and years. More importantly, Icehouse Ventures expanded its investment as the ambitions and possibilities for companies expanded.

So, is Fund I now certain to generate a high-multiple cash return?

Paul says the answer to that question is no, and so it should be three years into the fund’s ten-year term. Were a high-multiple return to be regarded as certain within such a short space of time, competition to invest would have been so strong that founders would have had to give up very little equity to raise all the capital they needed.

As evidenced by companies such as Rocket Lab, PowerbyProxi, Vend and many others, it can take more than ten years for companies to deliver consequential returns.

That is the bad news, Paul says. The good news is that Growth Fund I started investing in companies like Halter, Tradify, Shuttlerock and Crimson when they were already more than seven years old.

Paul is confident that in three years’ time Icehouse will be able report strong overall returns for Growth Fund I. In the meantime, fundraising remains to be completed for a second fund in challenging economic conditions. But, historically, challenging economic conditions have provided excellent investment opportunities.

Image: Performance of Icehouse Growth Fund I. This chart was created before the exit of the investment in Tradify.